Revolutionise Your Stocking Finance Process with Pre-Check

Efficiently Validate Assets, Reduce Cost, and Streamline Wholesale Operations

Pre-Check is built from the ground up to address the key issues of eliminating significant risk from the wholesale lending process whilst enabling banks to grow their portfolios in an increasingly challenging market

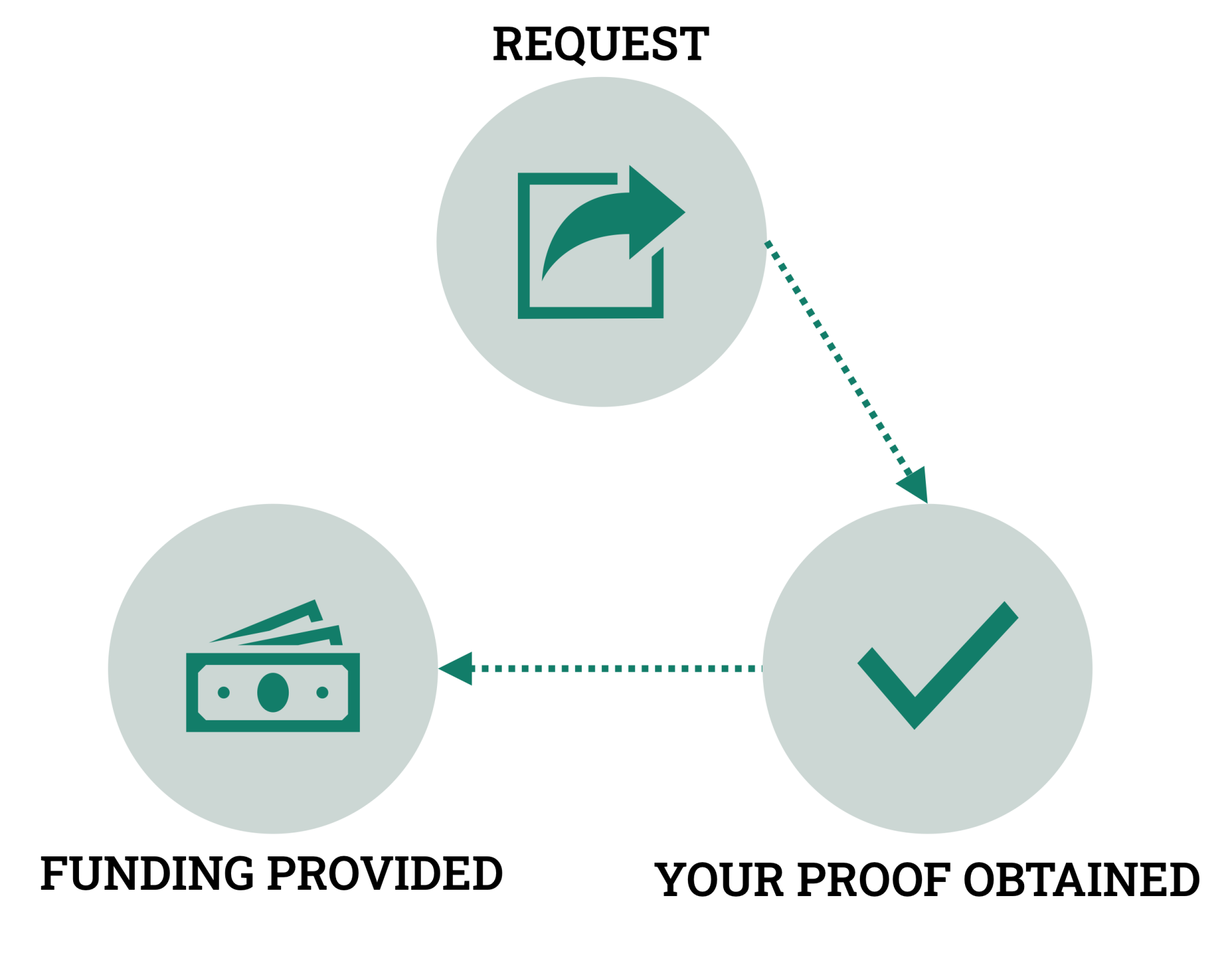

Get proof before funding

With the funder in control, the onus is now on the dealer to provide the correct documentation

Introducing Pre-Check: A Paradigm Shift In Stocking Finance

What is Pre-Check?

A comprehensive dealer portal designed to automate asset validation and pre-funding documentation

What does it do?

Streamlines the asset validation process, eliminates manual errors, and speeds up funding

Who Is It For?

Specifically tailored for banks and finance companies involved in wholesale vehicle finance

The Impact

Mitigates risk, reduces cost, improves operational efficiency, supports market growth, and enhances data quality

Funders and dealers told us what their dream process would look like and the features they want ...

Simple user interface for dealers to self-serve 24/7

Multi-user for incremental proposals

Realtime, automated asset information

Built-in compliance assurance based on dynamic risk rules

Support supplemental information and documentation

Asset auto-validation and certainty

Instant funding and settlement

Transparent asset management process for all stakeholders

Robust audit trail

CASE STUDY

Enabling Used Vehicle Inventory Funding with Pre-Check

With automated asset validation, pre-funding documentation, and a user-friendly interface, Pre-Check empowers you to:

✔️ Mitigate risks associated with wholesale finance

✔️ Streamline your operations and improve efficiency

✔️ Make faster, more accurate funding decisions

✔️ Unlock new growth opportunities

Take the first step towards revolutionising your wholesale finance business. Contact us today to schedule a demo, learn more about Pre-Check, and discover how our cutting-edge platform can help you achieve your goals.

Simply fill in the form and a product expert will contact you by the next working day.